Introduction

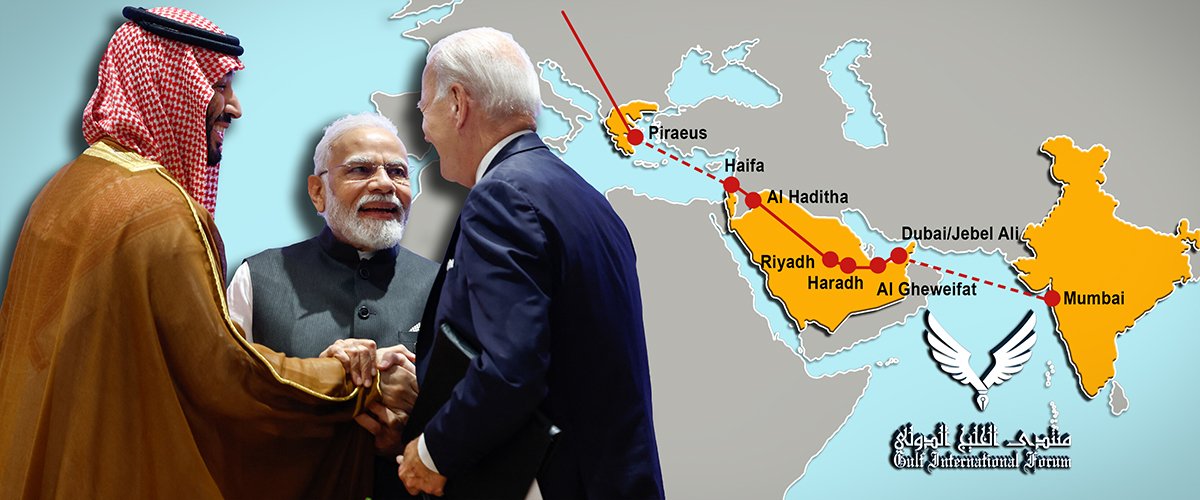

The India-Middle East-Europe Economic Corridor (IMEC [sometimes also abbreviated to IMEEC]) represents a transformative connectivity initiative that emerged from the G20 Summit in New Delhi on 9 September 2023. The memorandum of understanding was signed between India, the United States, the United Arab Emirates, Saudi Arabia, France, Germany, Italy, and the European Union, establishing a framework for enhanced economic integration between Asia, Middle-East, and Europe.[1]

IMEC comprises two distinct corridors: (1) The Eastern Corridor connecting India to the Persian Gulf, and (2) the Northern Corridor linking the Persian Gulf to Europe.[2] The Eastern segment currently encompasses maritime connectivity from the ports of Jawaharlal Nehru, Kandla and Mundra in India to the ports of Fujairah, Jebel Ali, and Khalifa (all in the UAE), and the Saudi Arabian ports of Dammam and Ras Al Khair, followed by railway networks connecting the UAE to Saudi Arabia and further to Israel, ultimately reaching Europe through the Israeli port of Haifa.[3] This multimodal approach integrates railways, shipping networks, and supporting infrastructure for electricity cables, digital connectivity, and clean hydrogen pipelines.[4] With the participating countries having a combined GDP of about 47 trillion USD (in 2023), IMEC represents nearly half of the world’s economic output.[5] The Eastern Corridor exhibits significant strategic vulnerabilities that underscore the need for alternative routing, probably through Oman. The planned route through the Strait of Hormuz, one of the world’s most critical oil transit chokepoints, facilitates approximately 20 per cent of global flows of oil and natural gas.[6] This narrow strait, with a width of just 33 km (17.82 NM) between Iran and the Musandam Peninsula, represents a critical vulnerability in IMEC’s operational framework.

Furthermore, the current reliance of the Eastern Corridor upon UAE and Saudi ports within the Persian Gulf creates exposure to the risk of regional conflicts. The planned infrastructure of the IMEC involves territories that are already witness to violent geopolitical tensions, including the Israel-Hamas conflict, which has repeatedly demonstrated its capacity to disrupt regional trade flows. The concentration of critical infrastructure nodes within a geographically constrained area amplifies systemic risks and reduces operational resilience.

The Strait of Hormuz Challenge

The Strait of Hormuz presents critical geopolitical risks for the IMEC implementation, primarily due to Iran’s ability to disrupt maritime operations. Iran controls the northern shore of this narrow waterway, giving Tehran significant leverage over international trade flows. Recent escalations following US strikes on Iranian nuclear facilities have intensified threats emanating from Tehran, with Iran’s parliament approving the closure of the Strait of Hormuz, although the final decision has been left to the Supreme National Security Council.[7] The Islamic Revolutionary Guard Corps (IRGC) maintains operational control over the Persian Gulf [8] and has demonstrated its ability and willingness to harass commercial shipping, as evidenced by tanker seizures and mining incidents over the past several years.

Geopolitical implications extend beyond immediate military threats. Iran’s strategic use of the strait as a lever in international negotiations creates persistent uncertainty for commercial operators.[9] Insurance costs for vessels transiting the strait have already increased substantially, from 0.125 per cent of ship value per transit to 0.2 per cent, marking a 60 per cent jump in the war-risk insurance premiums for vessels, with some shipping companies contemplating alternative routes to avoid potential risks.[10] The prospect of sustained closure could trigger global energy crises and supply chain disruptions affecting Indo-Pacific economies that are heavily dependent on energy imports from the Persian Gulf. The strait’s vulnerability directly threatens operational reliability and commercial viability. Any disruption of shipping through the strait would immediately affect flows of containerised cargo from India to the UAE, which is amongst India’s top export partners in the world. The concentration of major UAE ports, including Jebel Ali and Abu Dhabi, within the Persian Gulf creates systemic exposure to Hormuz-related disruptions. Considering the geopolitical vulnerabilities in the Strait, exploring Oman’s participation in IMEC presents an opportunity to bolster the project’s sustainability and reduce exposure to potential disruptions in the future.

Prospects of Oman’s Integration into IMEC

Oman’s integration into the IMEC presents compelling prospects rooted in geography, diplomatic neutrality, and economic complementarity. The sultanate’s strategic positioning along the Arabian Sea and the Indian Ocean, largely free from the geopolitical constraints of the Persian Gulf, offers IMEC critical advantages. As opposed to the current IMEC route’s vulnerabilities arising from the Strait of Hormuz, Oman’s ports at Salalah, Sohar, and Duqm provide direct access to the Arabian Sea.

Oman’s traditional diplomatic approach, characterised by neutrality and balanced regional engagement, provides stability advantages for international infrastructure investments.[11] Unlike other Persian Gulf States that are more or less directly involved in regional conflicts, Oman’s “Third Way” foreign policy offers a secure operating environment for multinational corridor operations.[12] This neutrality offers IMEC strategic insulation from regional tensions that have disrupted other corridor segments, particularly those involving Israel and Iranian-aligned actors.

Economic synergies aligning with IMEC’s objectives, in line with Oman Vision 2040, include facilitating seamless trade routes, fostering global energy security, promoting sustainable economic growth, enhancing regional connectivity, and driving technological innovations.[13]

Building on Oman’s strategic advantages and diplomatic neutrality, a closer examination of the Sultanate’s port infrastructure and capacity is essential in determining the feasibility and potential impact of its participation in IMEC.

Oman’s Port Infrastructure and Capacity

Oman’s maritime infrastructure encompasses a strategically distributed network of ports along its extensive coastline, each offering distinct advantages for IMEC integration. The country’s port system includes three major facilities— Salalah, Sohar, Duqm— which taken in aggregate, handle over 104 million tonnes of cargo annually (as of 2024). Table 1 refers. Container throughput across all Omani ports reached approximately 4.2 million TEU in 2024, with the port of Salalah contributing 3.3 million TEU and Sohar processing 942,000 TEU.[14] This substantial capacity, combined with ongoing expansion programs, positions Oman’s ports as viable alternatives to Persian Gulf facilities for IMEC operations.

| Port | Primary Function | Total Berths | Total Quay Length (m) | Maximum Draft (m) | Container Capacity (TEU) | Container Throughput (TEU) | 2024 Total Cargo (tonnes) | Key Expansion/ Developments |

| Salalah | Container trans-shipment hub | 21 | 5,197 | 18 | 6.5 million | 3.3 million (2024)

3.8 million (2023) |

21.2 million (2024) | 300 million USD expansion (completed 2024) |

| Sohar | Multi-purpose deep-water facility | 21 | 6,270 | 25 | 1.5 million | 942,051 (2024),

818,000 (2023) |

75.2 million (2024) | Significant growth in breakbulk/ro-ro |

| Duqm | Strategic Greenfield Port | 3 | 2,200 | 19 | 3.5 million | 16,000 (2023) | 8.4 million (2024) | Exceptional 152% cargo increase (2024) |

Port Efficiency and Performance Metrics

Salalah Port’s ranking as the world’s second most efficient container port, according to the 2023 Container Port Performance Index (CPPI), establishes it as a globally competitive facility for IMEC integration.[15] With 164.72 index points and handling 1,146 vessel calls in 2023, Salalah achieved the top position in the West Central and South Asia region.[16] Salalah’s consistent performance demonstrates operational excellence that rivals international benchmarks, ranking second only to Yangshan Port in China (177.9 index points, 3,509 vessel calls). Its expansion from 5 million TEU to 6.5 million TEU, through the completed upgrade that cost 300 million USD, represents an increase of 44% in terms of capacity. General cargo throughput climbed to 22.6 million tonnes in 2024, up from 20.6 million tonnes the previous year, driven primarily by limestone, gypsum, and dry bulk volumes. However, container volumes declined to 3.3 million TEU from 3.8 million TEU in 2023, attributable to the uncertainties of shipping through the Red Sea.[17] The port’s efficiency stems from its strategic location, expanding connectivity, and world-class operations, all of which provide customers with significant competitive advantages in regional markets.[18] This performance directly supports IMEC objectives by ensuring rapid cargo processing capabilities essential for corridor operations.

Other Omani ports do not have quite the same comprehensive international efficiency ranking as does Salalah but, nevertheless, have impressive operational capabilities. Sohar Port, for instance, demonstrated exceptional growth, with breakbulk cargo achieving 77% growth to reach 1.57 million tonnes in 2024. Likewise, overall cargo volumes reached 74.5 million tonnes (a 2.6% decline from 2023 notwithstanding), container throughput jumped 15% to 943,000 TEUs, while Ro-Ro traffic surged 25% to 87,000 units, and ship-to-ship transfer activity increased 19% to 3.3 million tonnes.[19] In similar fashion, the port of Duqm recorded an exceptional 152% increase in cargo-handling, reflecting enhanced operational efficiencies and a rising demand for integrated port services.[20] The port’s focus on breakbulk, project cargo, and dry bulk operations has creating globally recognised operational expertise for specialised handling requirements.[21]

Regional comparison reinforces Omani facilities competitive positioning within GCC markets. While UAE ports maintain larger absolute volumes, with Jebel Ali handling 14.5 million TEU and Khalifa Port processing 4.3 million TEU in 2022 (Khalifa Port ranked third globally in the 2022 CPPI, while Saudi Arabia’s King Abdullah Port had topped the 2021 rankings), Omani ports nevertheless demonstrate superior efficiency metrics in several categories. Perhaps most important of all is the strategic positioning of Omani ports which, located as they are outside the Persian Gulf provide increasingly valued security advantages as geopolitical tensions persist, potentially influencing commercial routing decisions favouring IMEC’s resilience objectives.

Given the importance of Oman’s ports in the IMEC, assessing the country’s inland connectivity infrastructure will be crucial to identifying opportunities for optimisation and ensuring the smooth flow of goods and services.

Inland Connectivity Infrastructure Assessment

The 238 km Hafeet Rail, a US$ 2.5 billion joint venture between Etihad Rail, Oman Rail, and the Mubadala Investment Company, provides the backbone for rail integration between the port of Sohar and the UAE National Rail Network.[22] Financial closure in October 2024 secured 1.5 billion USD in syndicated debt from Emirati, Omani and international banks, ensuring timely delivery. The engineering design specifies 60 bridges (some 34 m high) and 2.5 km of tunnels to negotiate complex topography while preserving operational efficiency.[23] The line supports high-capacity freight operations at 120 kmph one of the largest integrated diversified providers of rolling stock and infrastructure solutions and technologies for the global rail industry. with trainsets expected to haul over 15,000 tonnes, roughly 270 TEU per journey, directly aligning with IMEC’s throughput requirements.[24]

Twelve planned stations will interlink five deep-water ports and associated industrial zones across both states, embedding maritime-rail multimodality at corridor scale.[25] Recent contract awards to Larsen & Toubro (L&T) and Power Construction Corporation of China (abbreviated to “Power China”— a wholly state-owned Chinese enterprise) for automated logistics complexes at Al Buraimi and Sohar, together with the supply of next-generation wagons by the CRRC Corporation Limited (a Chinese state-owned rolling stock manufacturer) and 27 heavy-haul locomotives from Progress Rail (one of the largest integrated diversified providers of rolling stock and infrastructure solutions and technologies for the rail industry headquartered in the USA), underscore accelerated implementation and compliance with international heavy-axle standards.[26] The project’s governance architecture aligns with Oman Vision 2040 and UAE Centennial 2071, while its Hormuz-independent routing directly advances IMEC’s resilience objectives.

Oman’s mature highway system sustains seamless port-to-border flows. The 725 km Rub al Khali (Empty Quarter) highway, opened in late 2021, furnishes a direct Saudi–Oman artery with border infrastructure capable of processing 966 freight trucks daily.[27] Within Oman, 16,000 km of paved roads including the eight-lane Al Batinah Expressway, linking Muscat to the Khatmat Malaha UAE crossing, provide express connectivity to the port of Sohar, enabling two-to-three-hour trucking to Abu Dhabi and Dubai under normal traffic.[28] The port of Salalah presently relies on the north–south coastal and desert corridors, whereby commercial vehicles cover the 1,022 km Salalah–Dubai route in approximately 16 hours, offering an operational interim alternative for time-critical cargo.[29]

The port of Duqm connects via the Muscat coastal highway and GCC road grid, requiring eight-to-ten-hour transits, yet delivering strategic diversification by situating cargo south of the Strait of Hormuz.[30] Omani authorities have floated tenders for 42 additional road projects including the dualisation of the Adam Thumrait artery to elevate capacity and safety along IMEC-relevant corridors.[31] Concurrent border modernisation introduces smart customs platforms and Global Navigation Satellite System (GNSS)-enabled tolling, reducing administrative dwell and distance-based user costs, thereby enhancing the competitiveness of road haulage within the emerging corridor architecture. Continuous deployment of Information Technology Systems (ITS) enables real-time traffic monitoring, while planned hydrogen-ready truck-refuelling corridors align with IMEC’s decarbonisation mandate and Oman’s Net-Zero 2050 infrastructure resilience strategy.[32]

Strategic Case for Oman’s IMEC Integration

Oman’s integration into the IMEC offers comprehensive solutions to the corridor’s geopolitical vulnerabilities. This geographical positioning eliminates the chokepoint risk that the current IMEC routeing faces, providing resilient alternatives that are immune to Iranian interdiction.[33]

This risk-mitigation extends beyond operational concerns to encompass broader regional stability considerations. Oman’s traditional neutrality and balanced diplomatic approach provide insulation from regional conflicts that could disrupt other Gulf-based infrastructure.[34] The Sultanate’s successful maintenance of constructive relations with both Iran and Western powers creates a stable operating environment for international investments.[35] This diplomatic positioning becomes particularly valuable as regional tensions persist, with the Strait of Hormuz experiencing heightened threat levels and shipping disruptions.[36]

Diversification of critical infrastructure across multiple countries reduces systemic risk exposure inherent in concentrated facility networks. Incorporating Omani alternatives provides redundancy that enhances overall network resilience and maintains operational continuity during crisis periods. Integration significantly enhances connectivity by providing access to previously underutilised geographical advantages and transportation networks. This geographical diversity enables optimised routing based on cargo characteristics and prevailing security conditions.

Connectivity benefits extend to terrestrial networks through the earlier-mentioned Hafeet Rail infrastructure linking Omani ports to the UAE National Rail Network.[37] This integration enables cargo arriving at Omani ports to access the entire GCC railway network without requiring additional maritime transfers. Strategic positioning relative to major trade routes enhances connectivity to broader international networks. Salalah’s established role as a transshipment hub for the East African, and West Asian markets provides proven connectivity to global shipping networks.[38] The port’s integration with major shipping alliances, including the Gemini network involving such global players as Maersk and Hapag-Lloyd, ensures compatibility with international logistics operations.[39]

The development of specialised economic zones around major ports creates comprehensive logistics ecosystems that enhance regional connectivity beyond simple cargo transfer functions. The integration of the Sohar Freezone with port operations provides value-added services including manufacturing, processing, and distribution capabilities.[40] Likewise, the Special Economic Zone at Duqm offers similar synergies with additional advantages from renewable energy integration and green hydrogen production[41].

Digital connectivity enhancements support the modernisation of regional logistics networks aligned with IMEC’s technological objectives. Oman’s investments in digital infrastructure, including the National Port Community System and smart port technologies, create foundations for advanced connectivity features envisioned in IMEC planning.[42] These capacities support the corridor’s objectives for secure, high-speed data transmission alongside physical cargo movements, positioning Oman as a critical node in the emerging digital trade infrastructure.[43]

Implementation Framework

Successful IMEC integration demands comprehensive infrastructure development across multiple domains to ensure seamless connectivity and operational efficiency. Port infrastructure standardisation requires implementing Salalah Port’s world-class efficiency benchmarks across the other ports of Oman, with container handling equipment compatibility and common port management software enabling integrated logistics operations.

The Hafeet Rail project completion represents the most critical requirement, while reducing Abu Dhabi-Sohar journey time to 100 minutes.[44] Technical specifications must ensure compatibility with international freight standards, including gauge uniformity and operational protocols supporting cargo volumes.

Digital infrastructure requirements encompass blockchain-based cargo tracking systems providing transparency and security throughout supply chains. High-speed data connectivity supporting submarine cable infrastructure linking Omani ports to the broader network will optimise cargo throughput and operational efficiency. Supporting infrastructure includes warehousing facilities, inland logistics parks, and modernised customs infrastructure implementing single-window clearance systems to reduce administrative delays.

Considerations for India

The ports of Salalah, Sohar, and Duqm have become deeply integrated into China’s Belt and Road Initiative (BRI), positioning the Sultanate as a crucial node in Beijing’s Maritime Silk Road. The China-Oman Industrial Park at Duqm represents a flagship project of the BRI, with Chinese investments of the order of US$ 10.7 billion, through a 50-year lease agreement.[45] Similarly, the port of Sohar has established a sister-port agreement with China’s Shenzhen Port, facilitating enhanced connectivity within China’s 21st-century Maritime Silk Route networks.[46]

However, India’s concerns regarding BRI can be addressed through a constructive partnership approach that offers Oman viable economic alternatives while respecting its sovereignty and strategic autonomy. Rather than compelling Oman to withdraw from Chinese investments, India should leverage its historical maritime ties and complementary economic strengths to present attractive partnership opportunities. The India-Oman Comprehensive Economic Partnership Agreement (CEPA), is nearing finalisation and represents a transformative framework offering Oman access to 98 per cent of Indian products and significant service sector liberalisation.[47]

Likewise, the 2017 MoU between the Adani Group and Duqm Port has set an official framework for investment and cooperation demonstrates a constructive approach, with ongoing discussions for port development complementing the existing 1.2 billion USD Indo-Omani joint venture for the region’s largest sebacic acid plant.[48] The third tranche of the Oman-India Joint Investment Fund, worth US$ 300 million, channels investments into India’s fastest-growing economic sectors while creating reciprocal opportunities for Omani diversification.[49] India’s approach offers Oman genuine multi-alignment opportunities, reducing dependency on single-source investments while maintaining existing relationships and promoting balanced, sustainable development that enhances regional stability.

Conclusion

Oman’s integration into the IMEC represents a strategic imperative that directly addresses the corridor’s most critical vulnerabilities while unlocking transformative economic opportunities for regional connectivity. The confluence of geopolitical risks inherent in the current route’s dependence on the Strait of Hormuz, combined with Oman’s geographical advantages and diplomatic neutrality, creates compelling justification for immediate inclusion in the corridor framework.

The strategic case rests on three fundamental pillars: (1) risk mitigation through geographic diversification; (2) enhanced operational resilience via world-class port infrastructure; and (3) diplomatic stability through Oman’s proven neutrality. Salalah Port’s ranking as the world’s second most efficient container facility, coupled with the Hafeet Rail project creating seamless multimodal connectivity, establishes the infrastructure foundation necessary for IMEC integration. The Sultanate’s balanced approach to international partnerships, exemplified by its constructive engagement with both Chinese BRI investments and emerging Indian partnerships through the forthcoming CEPA, demonstrates sophisticated multi-alignment that enhances corridor objectives.

Implementation requires coordinated action across diplomatic, infrastructural, and commercial domains. The existing momentum from India-Oman bilateral initiatives, including the joint investment fund and ongoing port development agreements, provides established frameworks for expanded cooperation. Rather than viewing Chinese presence as an impediment, India’s approach should leverage complementary strengths to offer Oman genuine alternatives that respect its sovereignty while advancing mutual strategic interests. The corridor’s ultimate success depends on recognising that Oman’s integration transforms IMEC from a geographically constrained initiative into a resilient, multi-route network capable of withstanding regional disruptions while maximising economic efficiency.

******

About the Author

Ms Annem Naga Bindhu Madhuri is a Research Associate at the National Maritime Foundation. Her research focus is on Maritime Connectivity. She did her Master’s in Defence and Strategic Studies. She can be contacted at marcon3.nmf@gmail.com

Endnotes:

[1] Government of India, Ministry of External Affairs, Partnership for Global Infrastructure and Investment (PGII) & India–Middle East–Europe Economic Corridor (IMEC), Press Release, New Delhi, 09 September 2023, https://www.mea.gov.in/press-releases.htm?dtl/37091/Partnership_for_Global_Infrastructure_and_Investment_PGII__IndiaMiddle_EastEurope_Economic_Corridor_IMEC

[2] Government of India, Partnership for Global Infrastructure and Investment (PGII), 09 September 2023.

[3] Research and Information System for Developing Countries (RIS), India–Middle East–Europe Economic Corridor (IMEC): Strategic Choices and Way Forward, report (New Delhi: RIS, March 2025), https://www.ris.org.in/sites/default/files/Publication/IMEC%20Report‑Web.pdf

[4] The White House, “Memorandum of Understanding on the Principles of an India–Middle East–Europe Economic Corridor,” statement, Washington, DC, 09 September 2023, https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2023/09/09/memorandum-of-understanding-on-the-principles-of-an-india-middle-east-europe-economic-corridor/

[5] “Strategic Crossroads: Exploring the Geopolitical Dimensions of the India–Middle East–Europe Economic Corridor,” Financial Express (Defence News), 14 September 2023, https://www.financialexpress.com/business/defence-strategic-crossroads-exploring-the-geopolitical-dimensions-of-the-india-middle-east-europe-economic-corridor-3243568/

[6] Mannat Jaspal, “Strait of Hormuz: Energy Security & Geopolitics,” Observer Research Foundation Middle East, 18 June 2025. https://orfme.org/research/strait-of-hormuz-energy-security-geopolitics/

[7] Government of India, “Iran Approves Closure of Strait of Hormuz after US Strikes on Nuclear Sites,” Akashvani (NewsOnAir), 23 June 2025. https://www.newsonair.gov.in/iran-approves-closure-of-strait-of-hormuz-after-u-s-strikes-on-nuclear-sites/

[8] “Iran’s Revolutionary Guards Seize Oil Tanker in Persian Gulf – State Media,” Iran International, 8 April 2025. https://www.iranintl.com/en/202504083032

[9] Jaspal, “Strait of Hormuz,” 18 June 2025.

[10] “Risky Strait: Marine Insurance Costs Surge,” The Economic Times – BFSI, 25 June 2025. https://bfsi.economictimes.indiatimes.com/articles/marine-insurance-premiums-surge-as-tensions-escalate-in-strait-of-hormuz/122059471

[11] Eleonora Ardemagni, “Oman’s Sultan Goes to the UAE: Why It Matters Also to the US and China,” ISPI Online, 24 April 2024. https://www.ispionline.it/en/publication/omans-sultan-goes-to-the-uae-why-it-matters-also-to-the-us-and-china-171721

[12] Ardemagni, “Oman’s Sultan Goes to the UAE.”

[13] Government of Oman, “Oman Vision 2040: Vision Document,” Oman Vision 2040. https://www.oman2040.om/OmanVision2040Report?lang=en

[14] Oman Observer, “Oman Ports Drive Trade Growth.”

[15] “Regional Disruptions Drive Changes in Global Container Port Performance Ranking,” World Bank press release, 4 June 2024. https://www.worldbank.org/en/news/press‑release/2024/06/01/regional‑disruptions‑drive‑changes‑in‑global‑container‑port‑performance‑ranking

[16] Government of Oman, “Salalah Port Ranked as Second Most Efficient Container Port in the World,” Ministry of Foreign Affairs, 25 June 2024. https://www.fm.gov.om/salalah-port-ranked-as-second-most-efficient-container-port-in-the-world/

[17] Conrad Prabhu, “Oman: Mineral Exports Boost Salalah Port Volumes in 2024,” Zawya, 5 March 2025. https://www.zawya.com/en/economy/gcc/oman-mineral-exports-boost-salalah-ports-general-cargo-volumes-in-2024-j376x560

[18] World Bank, “Regional Disruptions Drive Changes in Global Container Port Performance Ranking.”

[19] “Sohar Port and Freezone Drive Sustainable Growth,” Oman News, 20 January 2025. https://omannews.gov.om/topics/en/80/show/120596

[20] Oman Observer, “Oman Ports Drive Trade Growth.”

[21] Asian Infrastructure Investment Bank, Project Learning Review: Duqm Port Development.

[22] Fahad Al Mukrashi, “Oman–UAE Railway Project Picks Up Pace: $2.5 Billion Network to Boost Trade and Connectivity,” Gulf News, 6 May 2025. https://gulfnews.com/world/gulf/oman/oman-uae-railway-project-picks-up-pace-25-billion-network-to-boost-trade-and-connectivity-1.500116997

[23] “UAE–Oman Hafeet Rail Project Achieves Financial Close,” Zawya Projects, 10 October 2024. https://www.zawya.com/en/projects/construction/uae-oman-hafeet-rail-project-achieves-financial-close-b8d1uvel

[24] Al Mukrashi, “Oman–UAE Railway Project Picks Up Pace,” Gulf News.

[25] Zawya Projects, “UAE–Oman Hafeet Rail Project Achieves Financial Close.”

[26] “Hafeet Rail Awards Freight Terminal and Wagon Contracts,” Railway Gazette International, 10 February 2025. https://www.railwaygazette.com/freight/hafeet-rail-awards-freight-terminal-and-wagon-contracts/68283.article

[27] Conrad Prabhu, “Oman Tenders First Phase of Rub al Khali Road Dualisation,” Oman Observer (Business/Economy), 30 October 2023. https://www.omanobserver.om/article/1144952/business/economy/oman-tenders-first-phase-of-rub-al-khali-road-dualisation

[28] Oman News Agency, “Oman Expands Road Network for Economic and Tourism Growth,” Oman Observer (Business/Economy), 18 January 2025, https://www.omanobserver.om/article/1164991/business/economy/oman-expands-road-network-for-economic-and-tourism-growth.

[29] BBC Cargo Serives, “Shipping from Dubai to Oman,” logistics service page, last accessed on 28 June 2025. https://www.bbccargo.ae/shipping-from-dubai-to-oman/

[30] Dr Yousuf Bin Hamed Al Balushi, “GCC Economic Integration through Connectivity,” Oman Observer (Opinion/Business), 30 June 2025. https://www.omanobserver.om/article/1172725/opinion/business/gcc-economic-integration-through-connectivity

[31] “Contracts Awarded for 400 km Adam–Thamrait Road Dualisation,” Oman Observer (Oman/Transport), 14 November 2024. https://www.omanobserver.om/article/1162087/oman/transport/contracts-awarded-for-400-km-adam-thamrait-road-dualisation

[32] “Oman Steps Up Efforts to Achieve Net Zero by 2050,” Muscat Daily, 6 October 2024. https://www.muscatdaily.com/2024/10/06/oman-steps-up-efforts-to-achieve-net-zero-by-2050/

[33] Lori Ann LaRocco, “Shipping Threats around Arabian Peninsula Rising, Largest Global Shipowners Organization Warns,” CNBC, 22 June 2025. https://www.cnbc.com/2025/06/22/threat-to-commercial-shipping-around-arabian-peninsula-is-rising-largest-global-shipowners-organization-warns.html

[34] Bilal Bilici, “Oman’s Diplomacy Is Impeccable and Indispensable,” Times of Oman, 10 June 2025. https://timesofoman.com/article/159112-omans-diplomacy-is-impeccable-and-indispensable

[35] Alia Yasmin Jawad and Simon Tzourbakis, “Oman’s Diplomatic Balancing Act: Bridging East and West across a Divided Middle East,” MEI Switzerland, 7 April 2025. https://meiswitzerland.ch/en/themes-loc/omans-diplomatic-balancing-act-bridging-east-and-west-across-a-divided-middle-east

[36] Nuran Erkul and Emir Yildirim, “Shipping Firms Stay Cautious in Strait of Hormuz,” Anadolu Agency, 24 June 2025. https://www.aa.com.tr/en/middle-east/shipping-firms-stay-cautious-in-strait-of-hormuz/3611627

[37] Al Mukrashi, “Oman–UAE Railway Project Picks Up Pace,” Gulf News.

[38] Government of Oman, Salalah Port, Salalah Port Authority. https://www.salalahport.com.om/

[39] “Port of Salalah Invests US $300 Million to Meet New Gemini Cooperation Needs,” Asia Cargo News, 24 February 2025. https://www.asiacargonews.com/zh-cn/news/detail?id=10575

[40] Government of Oman, “Continuous Growth of Special Economic Zones and Free Zones,” Issue 22, Duqm Special Economic Zone Authority, June 2021. https://opaz.gov.om/upload/files/Freezones_Duqm_magazine-_22Issue_EN.pdf

[41] https://www.omanobserver.om/article/1151644/business/energy/hyport-duqm-set-to-be-among-worlds-first-green-hydrogen-projects

[42] Dom Magli, “Kale to Build Oman’s National Port Community System,” Port Technology International, 7 May 2025. https://www.porttechnology.org/news/kale-to-build-omans-national-port-community-system/

[43] Faisal Al Ajmi, “Industrial and Economic Hubs Power Oman’s Vision 2040 Goals,” Oman Observer (Business/Economy), 14 April 2025. https://www.omanobserver.om/article/1169050/business/economy/industrial-and-economic-hubs-power-omans-vision-2040-goals

[44] “Hafeet Rail Project Moving at Steady Pace,” Oman Observer (Transport), 3 May 2025. https://www.omanobserver.om/article/1169938/oman/transport/hafeet-rail-project-moving-at-steady-pace

[45] “BRI‑Backed Oman Economic Zone Attracts Raft of Global Investors,” HKTDC Belt & Road Portal, 2 May 2019. https://beltandroad.hktdc.com/en/insights/bri-backed-oman-economic-zone-attracts-raft-global-investors

[46] “SOHAR Signs Sister Port Agreement with Shenzhen in China,” Arab News, 7 December 2016, https://www.arabnews.com/node/1020491/corporate-news

[47] “India, Oman Close to Finalizing Free Trade Agreement: Piyush Goyal,” DD News, 2 June 2025. https://ddnews.gov.in/en/india-oman-close-to-finalizing-free-trade-agreement-piyush-goyal/

[48] “Duqm Port Holds Discussions with Adani Group for Investment in Region,” Times of Oman, 6 March 2024. https://timesofoman.com/article/142871-duqm-port-holds-discussions-with-adani-group-for-investment-in-region

[49] Oman–India Joint Investment Funds Establish Third Fund Builds on Success of First Two Funds — OIA Chairman, DD News, 17 December 2023. https://ddnews.gov.in/en/third-oman-india-joint-investment-funds-establishment-builds-on-success-of-first-two-funds-oia-chairman/

https://gulfif.org/

https://gulfif.org/

https://www.ogc.org/

https://www.ogc.org/

Leave a Reply

Want to join the discussion?Feel free to contribute!