Recent Large Discoveries

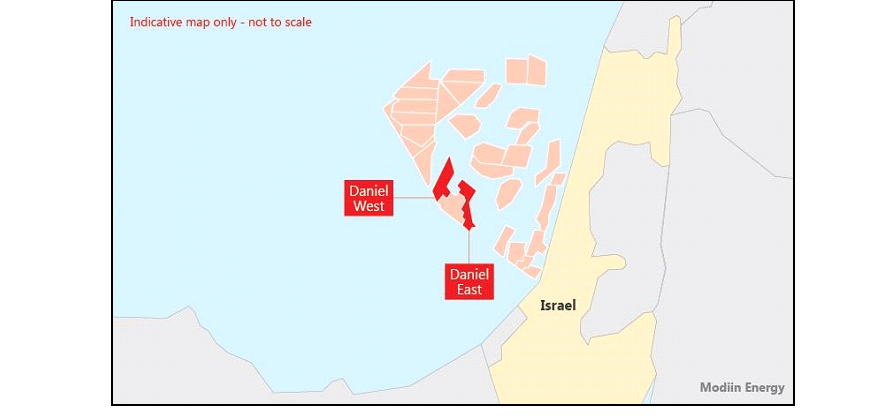

In January 2016, an Israeli gas exploration group, led by the Isramco Negev and Modiin Energy companies, discovered two large gas reservoirs off Israel’s Mediterranean shore, Daniel East and Daniel West fields. A preliminary evaluation report prepared by Texas-based consultants – Netherland Sewell & Associates – estimates they hold 8.9 trillion cubic feet of natural gas. The recent discoveries are big as the Tamar field, which was discovered in 2010 and is now functioning at a full production capacity. However, they are still one third the size of the grand Leviathan field, which is estimated to hold nearly 22.9 trillion cubic feet but is still waiting development.

Map 1 – Location of Daniel Offshore Gas Fields (Israel)

(Source: Interfax Energy)

In addition, in the recent years, many natural gas discoveries have been made in the Levant basin, which is located in the eastern Mediterranean Sea. For example, Zohr Prospect off Egypt that is the largest discovery there so far, Aphrodite gas field off Cyprus, Gaza Marine off Gaza Strip, and so on.

Map 2 – Offshore Gas Fields in Levant basin

(Source: Economist)

These new offshore discoveries have intensified competition and cooperation among states in the region and oil companies from around the world. This has already begun to reorient strategic alliances in the adjoining land regions, like strengthening of Israel-Cyprus partnership. So far, Italy’s ENI, US’s Noble Energy, France’s Total S.A., South Korea’s Kogas and UK’s British Gas have taken the lead in gas exploration and production (E&P) in the region. However, new technical and political challenges are making the way for entry of new international oil players.

Prospects for India

The succeeding paragraphs explore the important facets of opportunities, challenges, and imperatives for India to participate in the newfound offshore discoveries in the Levant basin.

First, limited availability of domestic fossil fuels: Since independence, India has been regularly facing energy shortages. At present, this problem is further deteriorating. Therefore, it is trying to address the problem by importing energy resources from different overseas destinations and securing ownership stakes of foreign energy assets. The early stage of E&P of Levant gas offers opportunities for India to participate in various offshore development activities.

Second, growing national demand for natural gas: In recent years, India’s demand for natural gas has increased significantly. It has been addressing this situation by increasing imports of liquefied petroleum gas (LPG). Presently, it is attempting to diversify its excessive dependence of LPG imports from the Persian Gulf states by striking contracts with leading gas producing states, like the US, Australia, and others. The Levant basin gas will provide alternate import options forIndia, which it needs to take into consideration.

Third, Indian government policies necessitating high energy consumption: The policies of the present Indian government practically require high energy consumption. A good example is the ‘Make in India’ campaign of the government, which invites foreign companies to set their manufacturing base in India. These polices will yield expected results only if the national energy demand and security is met in assured terms. This further increases the scope of use of natural gas in the country.

Fourth, international pressure on climate change issues: Following the UNFCC COP 21 Paris summit (December 2015), which produced the Paris Agreement, India faces international pressure for taking climate change mitigation measures. So, it needs to decrease the use of oil and coal as both these fuels release excessive carbon dioxide (CO2) on burning, while simultaneously promote the greater use of natural gas due to its clean properties. Therefore, India needs to use natural gas as a “bridge fuel” for transitioning to a low-carbon economy.

Fifth, balancing relationships with states in the region: The adjoining land regions of the Levant basin have been witnessing violent conflicts, ranging from inter-state to intra-state conflicts, which are either unceasing or intermittent. Say for instance, Syria and Israel have been in a continuous state of war, Muslim Brotherhood refusing to accept General Al-Sisi led government in Egypt, and so on. The newfound gas discoveries will intensify the existing conflicts, which may lead to their spill-over into the sea. Under such circumstances, India will face challenges of balancing its relationships with different actors in the region while participating in any Levant gas business.

Last but not least, commercial prospects in the international energy market: Presently, as Indian oil companies are expanding globally, they need to attempt to participate in the new offshore gas projects in the Levant basin wherever they sense a ‘business case’ with assured returns on investments. If any Indian company is able to become a member of an offshore development consortium, then it may simply sell its quota of gas in the international market through equity holdings. It need not bring back the gas to India, if its profits are affected.

Conclusion

The recent offshore gas discoveries in the Levant basin have led to an influx of oil companies from around the world. Currently, more oil companies are coming in with the expectation of making profits on their investments when international oil and gas prices rebound in the near-future. Despite the various conflicts occurring in the adjoining areas, the development of these undersea reserves has not been affected as yet.

The challenges for India to secure stakeholder participation in Levant basin come along with opportunities for addressing national energy security, securing environmental sustainability and reaping commercial benefits. Therefore, India needs to prudently enter this ‘gas-rich’ region.

****************************

About the Author:

Hriday Sarma is a Research Associate at the National Maritime Foundation (NMF), New Delhi. The views expressed are his own and do not reflect the official policy or position of the NMF. He can be reached at hridaysarma@yahoo.co.in

Image Credits: USGS

Image Credits: USGS Image Credits: The Quint

Image Credits: The Quint

The White House

The White House  Indian Navy and Sea Power Centre - Australia

Indian Navy and Sea Power Centre - Australia  INLAND WATERWAYS AUTHORITY GOI

INLAND WATERWAYS AUTHORITY GOI  Image Credits: DNA India

Image Credits: DNA India Image Credits: Partnership for Regional Ocean Governance

Image Credits: Partnership for Regional Ocean Governance

Leave a Reply

Want to join the discussion?Feel free to contribute!