Abstract

Excess crude oil in the global market, coupled with the drastic reduction of consumption in the wake of the COVID-19 pandemic and the resultant curtailment of seaborne transport, have led to a phenomenon hitherto unseen in the 160 years since the beginning of the mass production of crude oil. The resulting historically low oil prices have set off a panicked scramble to acquire suitable capacity for the storage of surplus crude oil stocks, be this by way of oil tankers, rail wagons, surface/underground tanks or caverns.

In April 2020, the US, China and India – the world’s three largest oil consumers – evinced keen interest to fill their respective Strategic Petroleum Reserve (SPR) sites with cheap oil that had flooded the market after Saudi Arabia and Russia went on a production overdrive to increase their market share. As the world’s third largest crude oil consumer, oil-deficient India is heavily dependent on imports. In 2018, India imported 83% of its total annual crude oil requirement.[1] In Financial Year (FY) 2019-20, India imported crude oil worth Rs. 7,16,627 crores (US$ 101.38 billion). In the same period, India also imported petroleum products worth Rs. 1,26,954 crores (US$ 17.85 billion). [2] Such a high dependence on imports to support its burgeoning economy makes India particularly sensitive to an increase in global crude oil prices. India’s import bill surges by US$ 1 billion for every US$ 1 increase in the price of crude oil per barrel.[3]

Events since January 2020 have revealed an unfamiliar corollary to the debate on energy security – the issue of excess oil during the interruption of supply. Here, the SPR, with the largest storage capacity in India, is expected to play a pivotal role in absorbing large volumes of cheap crude oil for Indian refiners.

This article focusses on the SPR — its features, its relevance to large crude-oil importing nations and its significance in enhancing India’s energy security. It is the first in a series of articles assessing the impact of low oil prices on global oil trade in general and storage capacity in particular.

Features of a Strategic Petroleum Reserve

A Strategic Petroleum Reserve (SPR) is a stockpile/hoard of crude oil and petroleum products. It is the primary emergency response measure to assuage brief interruptions in a country’s import of crude oil and petroleum products. Designed by the International Energy Agency (IEA) as the first of a two-part system to hedge against geopolitical threats to the supply of crude oil imports from the oil-producing nations in West Asia, this mechanism is increasingly being adopted by countries other than those belonging to the Organisation for Economic Co-operation and Development (OECD) for whom it was originally intended.[4] Demand-restraint measures like fuel rationing, prioritising fuel for essential services, fuel switching, etc., are secondary measures to moderate interim supply-disruptions.

Diesel, petrol (gasoline), aviation turbine fuel (jet fuel), heavy fuel oil (HFO),[5] kerosene, naphtha,[6] heating oil, lubricants, liquid petroleum gas (LPG) and asphalt are some of the commodities that are derived from refining crude oil. These petroleum products are not only essential for the transportation sector but also for construction, manufacturing, defence, agriculture, and households. However, the relatively short shelf life of most petroleum products makes crude oil (with a shelf life of more than five years) the most suitable commodity for long-term SPR. Conversely, liquefied natural gas (LNG) simply cannot be stored for an extended period.[7]

Crude oil and petroleum products are stored in underground caverns (deep subterranean cavities), tanks and even oil tankers. Among these alternatives, caverns offer the most viable option for the long-term storage of crude oil. It entails the injection of free-flowing unrefined crude oil into deep cavities drilled into salt domes or rock. The oil can be maintained in a liquid state for years, even decades! [8] SPR costs vary. In 2017, the cost of the construction of storage tanks on the surface was US$ 15-18 per barrel while the construction of storage capacity in rock caverns amounted to more than US$ 30 per barrel. At US$ 1.5 per barrel, storage in underground salt caverns is by far the cheapest storage option due to their capacity to store very large volumes of crude oil and their low-maintenance requirements.[9]

Cavern storage is optimum for the long-term storage of crude oil and its associated products. Nevertheless, experts caution against frequent withdrawals of SPR inventories. Contrary to popular belief, each underground cavern storage unit is designed for a limited number of drawdown cycles.[10] Each cycle comprises a large-scale withdrawal of the stockpiled commodity for dissipation on the open market or directed to the refineries of the country that owns either the stock or the storage capacity.

Typically, the location of the site hinges on three crucial elements:[11]

- Ease of Transport. Ports — with adequate facilities to offload crude oil — should connect to an SPR site through the most convenient mode of transport (rail, road, pipeline or shipping). Adequate connectivity should also be created with immediate refineries.

- A site should be sufficiently protected from external attack and resilient to extreme climatic and geological conditions.

- Location distribution. Proximity to several major centres of demand as well as arterial supply routes can ensure rapid dispersal and re-supply.

At the time of its inception, the IEA determined that member countries should create a stockpile of crude oil that could last up to three months following the disruption of regular supply. This 90-day stockpile was to be adjusted according to demand from the previous year. Mindful of the risk of misuse, the IEA recommends that stocks from the SPR be released only to counter physical shortages of crude oil. These emergency stocks are not to be used as instruments to neutralise price volatility or bridge long-term supply deficits. Countries with SPRs must shepherd resources against their misappropriation to satisfy domestic populist objectives.[12] But, the downward trend of oil prices for the past two years — reflecting the availability of alternate sources — exposes vulnerabilities of this mechanism and its high sunken costs. That brings one to the question of how India justifies its pursuit of such a venture.

Strategic Petroleum Reserves of India – Making the Most of Marginal Capacity

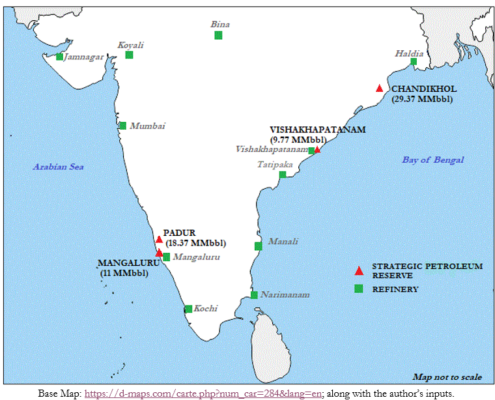

At present, India’s SPR sites at Padur (Karnataka), Vishakhapatnam (Andhra Pradesh) and Mangaluru (Karnataka), have a combined capacity of 39.14 million barrels (MMbbl) [Figure 1]. These facilities were completed in 2015, under Phase I of India’s SPR programme, which began in 2008. To streamline the construction of this critical infrastructure, India established the Indian Strategic Petroleum Reserve Limited (ISPRL), a Special Purpose Vehicle (SPV), as a wholly owned subsidiary of the Oil Industry Development Board (OIDB).[13] The OIDB, in turn, is under the administrative control of the Ministry of Petroleum & Natural Gas (MoP&NG), which, among its other responsibilities, synchronises the conveyance of crude oil and its storage in India.[14] As of March 2019, the ISPRL had invested Rs 4098.35 crore (around US$ 661 million; US$ 1 = Rs 62) in the three facilities under Phase I.[15]

| Figure 1. Strategic Petroleum Reserves of India (established and proposed)

|

Figure 1 also depicts Phase II of India’s SPR programme, which envisages an additional 47.64 MMbbl of storage capacity.[16] This includes the construction of a new facility at Chandikhol and the expansion of storage capacity at Padur on the west coast to store 36.65 MMbbl instead of the previous 18.37 MMbbl capacity. Such an expansion of petroleum storage capacity is expected to enhance the country’s stockpile within these strategic reserves to last for 22 days instead of the earlier 10 days (based on consumption figures for 2016-17).[17]

Although India planned to stockpile 132 million barrels, protracted delays in processing approvals has led to just a marginal creation of the initial target capacity.[18] Early analyses of the use of India’s SPR speculated that available stocks would be used to reduce price volatility for domestic refiners.[19] However, the high costs of crude oil prevailing at the time of the commissioning of these facilities prevented the immediate filling of these facilities. Instead, India has decided to lease these storage capacities to Indian refiners and foreign suppliers.[20] For instance, under the terms of the 7-year agreement signed during Prime Minister Narendra Modi’s visit to Abu Dhabi in February 2018, the Abu Dhabi National Oil Company (ADNOC) may sell one third of its inventory to Indian refiners and can only re-export it after the termination of the contract. Additionally, during an emergency, India has the first right to purchase this inventory at the prevailing market price.[21] Such an operating model encompasses the following attributes:

- As oil production increases, the lessee (any oil producing nation/Indian refiner) has a large and safe storage space available near its centres of demand.

- The lessor (ISPRL) earns revenue as the lessee pays for maintenance of the inventory, which can also be made available to Indian refiners during an emergency.

At first, Iraqi Basra Light crude oil was contracted by Hindustan Petroleum Corporation Limited (HPCL) for storage in the Vishakhapatnam SPR in June 2015.[22] India also sourced Iranian crude oil from the National Iranian Oil Company (NIOC) to fill up one storage unit at the Mangaluru SPR at a cost of Rs. 1754 crore (roughly US$ 230 million) in 2016. However, the re-imposition of the US-led trade embargo on Iran drove India to rely heavily on the benchmark Murban oil supplied by ADNOC.[23] Out of the 11 MMbbl capacity available at the Mangaluru SPR, ADNOC was contracted to supply 5.8 MMbbl by November 2018. Furthermore, Saudi Arabia’s national oil company (NOC) – Saudi Aramco – leased a portion of the Padur SPR in October 2019 to store 4.6 MMbbl of crude.[24]

Initial optimism to fill India’s SPR with leases to Saudi Arabia and the United Arab Emirates were dampened after the latter two countries sought larger incentives to store their oil. With the Chinese making a large play to secure cheap oil into their SPR, the two countries probably figured that they could get a better price for their product. Consequently, in the second week of April 2020, instead of making direct purchases, India’s MoP&NG diverted a part of the oil already purchased by Indian refiners from Iraq, Saudi Arabia and the United Arab Emirates (UAE) – some 19 MMbbl – for storage in the SPRs.[25] Diversion of purchases saves the refiners freight charges for floating storage (tankers) since onshore tanks are at capacity due to the nearly 70% fall in demand following the imposition of a nationwide COVID-19 lockdown in India on March 25, 2020.[26] [27]

The drastic fall in crude oil prices allows India to source cheaper oil that can be stores for a rainy day. To put it simply, India has struck gold. With average oil prices falling below US$ 20 per barrel by end-March 2020, ISPRL’s resistance to fill up the half-empty SPR capacity when average prices were less than US$ 60 per barrel seems to have hit pay dirt. For instance, the entity could have purchased crude oil at US$ 45 per barrel in June 2017 or at US$ 51 per barrel in December 2018. Yet, its forbearance has led to billions of dollars in savings for India, and, for the first time since their commissioning in 2015-16, India’s SPR inventory is at its maximum storage capacity.[28]

What about the US and China? How are they faring with their desire to soak up cheap oil into their own SPR inventories? The next article in this series will address this question and analyse the significance of the SPR amongst the world’s two largest oil consumers.

*Oliver Nelson Gonsalves is an Associate Fellow at the National Maritime Foundation. He can be contacted at associatefellow1.nmf@gmail.com.

Endnotes

[1] India 2020: Energy Policy Review, International Energy Agency, 2020, 251. https://webstore.iea.org/download/direct/2933?fileName=India_2020_Energy_Policy_Review.pdf

[2] Data for Crude and Products, Petroleum Planning & Analysis Cell, Ministry of Petroleum & Natural Gas, Government of India, https://www.ppac.gov.in/content/212_1_ImportExport.aspx

[3] Kapil Narula, “Time to fill up India’s strategic oil reserves,” Oxford Energy Forum, Issue 99 (February 2015): 10-12 https://ora.ox.ac.uk/objects/uuid:5d99813d-7b62-4a55-9b0d-c1b12563de72

[4] The Organisation for Economic Co-operation and Development (OECD) is a 36-member international organisation that was formed in 1961 with the objective of promoting economic development through the adoption of co-ordinated international policies. Its member nations are drawn from the world’s developed economies. The International Energy Agency (IEA) was created in 1974 to foster energy security among the oil-importing nations in the developed world. Non-OECD members cannot become gain membership of the IEA.

[5] Heavy Fuel Oil (HFO) or marine/bunker fuel is the most common fuel in shipping.

[6] Naphtha has several applications. It may be used as a raw material to produce solvents or gasoline, or for the dilution of heavy crude oil to enable its transportation through ship or pipeline.

[7] Suguru Kurimoto, “Hidden threat: Japan has only 2-week stockpile of LNG,” Nikkei Asian Review, 23 April 2020. https://asia.nikkei.com/Business/Energy/Hidden-threat-Japan-has-only-2-week-stockpile-of-LNG2

[8] John Shages, “The Strategic Petroleum Reserve: Policy Challenges in Managing the Nation’s Strategic Oil Stock,” accessed April 12, 2020: 3-6. https://eprinc.org/2014/07/strategic-petroleum-reserve-policy-challenges-managing-nations-strategic-oil-stock/#sthash.QEWiwDcS.dpbs

[9] Xilin Shi, Wei Liu, Jie Chen, et al., “Geological Feasibility of Underground Oil Storage in Jintan Salt Mine of China,” Advances in Materials Science and Engineering, Volume 2017: 2, https://doi.org/10.1155/2017/3159152.

[10] John Shages, “The Strategic Petroleum Reserve,” 3.

[11] H Li, Sun, R., Dong, K. et al., “Selecting China’s strategic petroleum reserve sites by multi-objective programming model,” Petroleum Science 14, 2017: 623, https://doi.org/10.1007/s12182-017-0175-0

[12] Varun Sivaram, “The Strategic Petroleum Reserve: A Policy Response to Oil Price Volatility?,” Council on Foreign Relations, June 15, 2016, blog post, https://www.cfr.org/blog/strategic-petroleum-reserve-policy-response-oil-price-volatility

[13] A Special Purpose Vehicle (SPV) is an entity created to focus on one task alone. In this case, ISPRL is charged only with the construction of storage capacity and the management of inventory.

[14] Annual Report, Oil Industry Development Board (OIDB), Ministry of Petroleum & Natural Gas, Government of India, 2018-2019: 7 http://www.oidb.gov.in/WriteReadData/LINKS/Annual_Report_201984be2034-4e81-4521-a9e7-de7327943909.pdf

[15] “Key Features,” Indian Strategic Petroleum Reserves Limited (ISPRL), accessed April 14, 2020, http://www.isprlindia.com/vishakhapatnam-site.asp

[16] “Cabinet approves establishment of additional 6.5 MMT Strategic Petroleum Reserves at Chandikhol in Odisha and at Padur, Karnataka,” Press Information Bureau, Government of India, accessed April 15, 2020, https://pib.gov.in/newsite/PrintRelease.aspx?relid=180215

[17]Ibid.

[18] Blake Clayton, “Lessons Learned From the 2011 Strategic Petroleum Reserve Release,” Council on Foreign Relations, Working Paper, September 10, 2012, https://www.cfr.org/report/lessons-learned-2011-strategic-petroleum-reserve-release

[19]Blake Clayton, “Lessons Learned From the 2011 Strategic Petroleum Reserve Release,” 17.

[20] Kapil Narula, “Time to fill up India’s strategic oil reserves,” 11.

[21] Florence Tan, “ADNOC to fill up Mangalore oil reserves in Nov: Indian officials,” Reuters, in The Economic Times¸ October 28, 2020. https://energy.economictimes.indiatimes.com/news/oil-and-gas/adnoc-to-fill-up-mangalore-oil-reserves-in-nov-indian-officials/66397925

[22] “IOC to import Iraqi oil for India’s maiden strategic reserve,” PTI, The Economic Times, last updated June 03, 2015 https://economictimes.indiatimes.com/industry/energy/oil-gas/ioc-to-import-iraqi-oil-for-indias-maiden-strategic-reserve/articleshow/47529587.cms?from=mdr

[23] Annual Report, Oil Industry Development Board (OIDB),

[24] “Saudi Aramco to store 4.6 Mn barrels of oil in India’s Padur reserve,” Reuters, in Business Today, last updated October 30, 2019 https://www.businesstoday.in/current/economy-politics/saudi-aramco-to-store-46-mn-barrels-of-oil-in-indias-padur-reserve/story/387458.html

[25] “India uses low crude prices to stockpile 32 million tonnes of oil,” PTI, Business Insider India, May 05. 2020, https://www-businessinsider-in.cdn.ampproject.org/v/s/www.businessinsider.in/india/news/india-uses-low-crude-prices-to-stockpile-32-million-tonnes-of-oil/amp_articleshow/75545968.cms?usqp=mq331AQFKAGwASA%3D&_js_v=0.1

[26] “India shuns Gulf producers, diverts refiners’ oil to SPR”, Reuters, in Energy World, April 09, 2020, https://energy.economictimes.indiatimes.com/news/oil-and-gas/india-shuns-gulf-producers-diverts-refiners-oil-to-spr/75063458

[27] “Oil, gas demand 70% down but India filled its strategic reserves: Pradhan,” ANI, Hindustan Times Auto News, May 4, 2020, https://auto-hindustantimes-com.cdn.ampproject.org/v/s/auto.hindustantimes.com/auto/news/oil-gas-demand-70-down-but-india-filled-its-strategic-reserves-pradhan/amp-41588591926405.html?usqp=mq331AQFKAGwASA%3D&_js_v=0.1#aoh=15886986182814&referrer=https%3A%2F%2Fwww.google.com&_tf=From%20%251%24s&share=https%3A%2F%2Fauto.hindustantimes.com%2Fauto%2Fnews%2Foil-gas-demand-70-down-but-india-filled-its-strategic-reserves-pradhan-41588591926405.html

[28] “India uses low crude prices to stockpile 32 million tonnes of oil,” PTI, Business Insider India, May 05. 2020, https://www-businessinsider-in.cdn.ampproject.org/v/s/www.businessinsider.in/india/news/india-uses-low-crude-prices-to-stockpile-32-million-tonnes-of-oil/amp_articleshow/75545968.cms?usqp=mq331AQFKAGwASA%3D&_js_v=0.1

IMAGE CREDITS- ONGC, HAZIRA.

IMAGE CREDITS- ONGC, HAZIRA.

Leave a Reply

Want to join the discussion?Feel free to contribute!